The U.S. Securities and Exchange Commission (SEC) has just dropped new guidance aimed at clarifying the murky world of tokenized securities.

This comes as more companies explore blockchain-based methods for issuing and managing securities.

The announcement breaks these digital assets into two main categories, helping firms understand how federal laws apply in this fast-evolving space.

Two Categories of Tokenized Securities

According to the SEC, tokenized securities can be broadly classified into two groups: those issued by the company itself — called issuer-sponsored tokenized securities — and those created by third parties with no affiliation to the issuer.

This distinction is key for companies navigating compliance and for investors evaluating risk.

Issuer-sponsored tokenized securities allow companies to “go digital” in two ways: either by recording ownership directly on a blockchain or by issuing crypto tokens that update traditional off-chain ownership records.

Despite the flashy new tech, the SEC emphasized that all existing securities laws, registration requirements, and legal obligations still apply.

Markus from the SEC put it plainly: whether a security is recorded on-chain or off-chain does not change its legal status.

Third-Party Tokenization: Custodial and Synthetic Models

Third parties unaffiliated with the original issuer can also tokenize securities, but their methods differ.

The SEC described two approaches: custodial and synthetic.

In the custodial model, the crypto token represents an indirect ownership stake in securities held in custody.

Think of it as a digital claim on assets stored elsewhere.

The synthetic model, meanwhile, involves creating new securities that mirror the performance of the underlying assets without giving actual ownership.

These “linked securities” can take the form of structured notes, exchangeable stock, or security-based swaps.

The takeaway from the SEC is clear: blockchain is a tool for recording and tracking ownership — not a way to bypass federal securities laws.

Industry Response and Market Trends

Industry players welcomed the clarity.

Tokenization platform Securitize said the SEC’s guidance “recognizes native, issuer-supported tokenization and on-chain recordkeeping as a modern extension of securities infrastructure.”

They highlighted that clear frameworks are essential to responsibly scale tokenized assets.

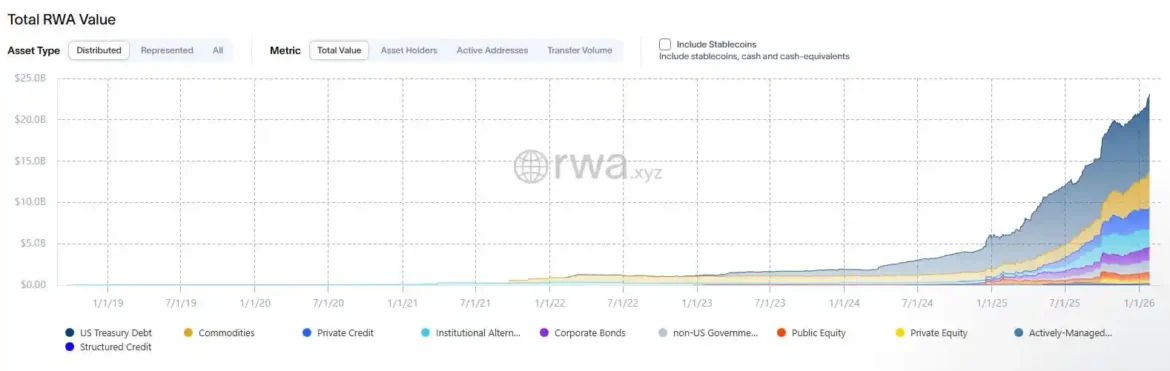

Meanwhile, the market for tokenized real-world assets (RWA) continues to surge, with on-chain value jumping 92% over the past year, according to RWA.xyz.

SEC Favors Broker Custody Over Self-Custody

The SEC also issued a cautionary note for investors holding third-party tokenized securities: these participants may face additional risks, including bankruptcy of the third party.

Historically, the regulator has favored broker-led custody systems over crypto-native self-custody solutions.

The guidance also supports the Depository Trust and Clearing Corporation (DTCC) in exploring on-chain settlement for certain U.S. stocks, bonds, and Treasuries — a signal that traditional finance may increasingly adopt blockchain technology while keeping regulatory safeguards intact.

What This Means Going Forward

For companies, the SEC’s guidance provides a clearer road map for entering tokenized securities markets without running afoul of federal laws.

For investors, it underlines that blockchain does not eliminate traditional risks but can make ownership and settlement more transparent.

As tokenized assets continue to gain traction, regulatory clarity like this is likely to encourage more mainstream adoption — as long as participants respect the rules.

The era of tokenized securities in the U.S. is taking shape, and companies and investors alike will need to balance innovation with compliance to navigate this evolving landscape.

Share on Facebook «||» Share on Twitter «||» Share on Reddit «||» Share on LinkedIn