Ripple is stepping into Saudi Arabia’s financial scene in a big way.

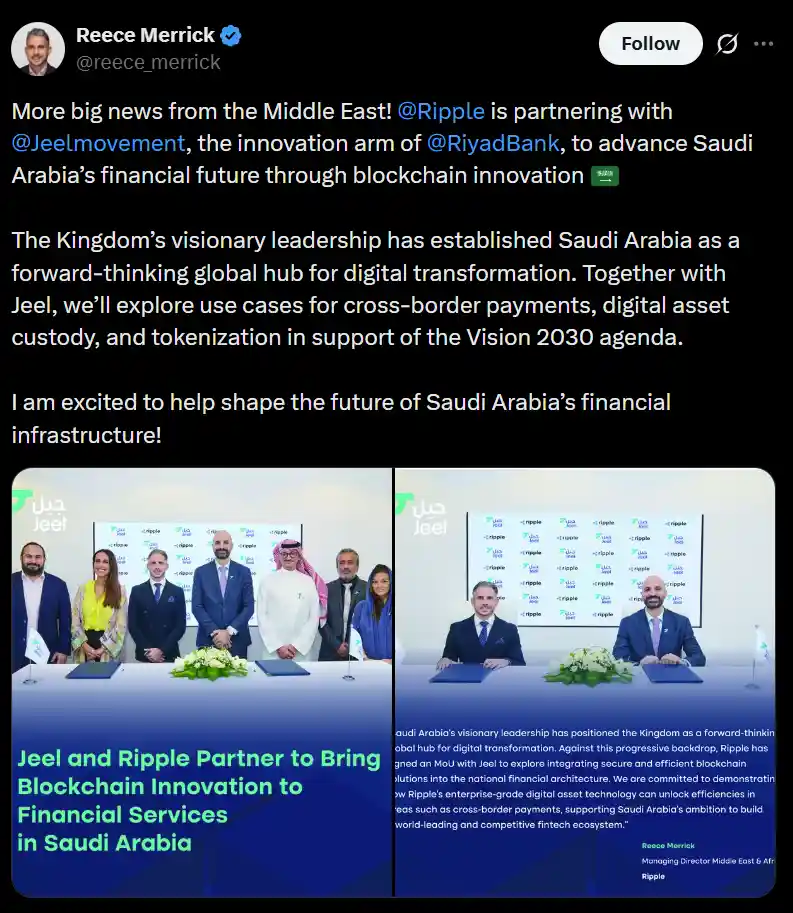

The blockchain payments giant has announced a partnership with Jeel, the innovation arm of Riyad Bank, one of the kingdom’s largest banks.

The move signals a growing interest in blockchain technology at the institutional level and could reshape parts of the financial system.

Reece Merrick, Ripple’s senior executive officer and managing director for the Middle East and Africa, confirmed the collaboration on Monday.

According to Merrick, the partnership will focus on studying how blockchain could improve cross-border payments, digital asset custody, and asset tokenization.

A Memorandum to Support Saudi Vision 2030

The collaboration will take the form of a memorandum of understanding (MoU) aimed at exploring real-world applications of blockchain.

Ripple and Riyad Bank plan to align their work with Saudi Arabia’s Vision 2030 strategy, the country’s ambitious plan to modernize its economy and financial infrastructure while reducing reliance on oil revenues.

With more than $130 billion in assets as of mid-2025, Riyad Bank is a heavyweight in the Saudi financial sector.

That scale makes this partnership particularly noteworthy, as any innovations could ripple across the domestic banking system.

Middle East Moves Toward Digital Assets

While Saudi Arabia has historically been cautious with blockchain and crypto, the broader Middle East is moving quickly.

The UAE, for example, has emerged as a hub for digital asset innovation, thanks to clear regulations and active engagement from international firms.

Dubai and Abu Dhabi now have dedicated frameworks covering exchanges, custody providers, and stablecoin issuers.

This regulatory clarity is helping global companies confidently operate in the region’s financial markets.

Ripple Expands in the UAE with RLUSD

Ripple has been riding this regional trend in the UAE.

The company has received regulatory approval for its Ripple USD (RLUSD) stablecoin, specifically designed for institutional payments and settlement use cases.

RLUSD circulation has already surpassed $1.3 billion, reflecting strong adoption.

Beyond the UAE, tokenization on public blockchains is also on the rise.

The XRP Ledger has now exceeded $1 billion in on-chain tokenized assets, showing increasing institutional engagement with blockchain infrastructure.

Tokenization Trends Driving Growth

The growth in tokenized assets has been fueled by a mix of US Treasury products, tokenized funds, and RLUSD itself, which is now traded on major platforms like Binance.

Ripple’s expansion in the Middle East and beyond highlights a broader trend: more institutions are exploring blockchain not just as a curiosity, but as a practical part of their financial operations.

Looking Ahead

This partnership between Ripple and Riyad Bank is more than a pilot project — it’s a sign that major financial institutions in the Middle East are taking blockchain seriously.

As countries like Saudi Arabia and the UAE push forward with regulation and innovation, blockchain-based financial infrastructure could soon become a core part of the region’s economy.

Share on Facebook «||» Share on Twitter «||» Share on Reddit «||» Share on LinkedIn