Why Many Nigerians Are Rejecting PayPal’s Return After Years of Exclusion

Earlier in January 2026, PayPal — the global payments giant used by hundreds of millions worldwide — finally announced it would allow Nigerians to receive international payments and withdraw funds locally through a partnership with Nigerian fintech firm Paga.

But instead of universal celebration, the announcement sparked noticeable anger, scepticism, and even calls for boycotts across Nigerian social media platforms like X (formerly Twitter) — especially among freelancers, gig workers and tech-savvy Nigerians.

A Long History of Exclusion

The root of the backlash lies in PayPal’s past: for nearly two decades, Nigerians were blocked from receiving funds, withdrawing international earnings, or using most inbound payment services on PayPal. Accounts were often stuck in “send-only” mode — meaning users could make payments abroad but not get paid, even from legitimate jobs or online clients.

This restriction started in the early 2000s, with the company citing fraud risk and compliance issues as reasons for limiting services to Nigeria and similar markets.

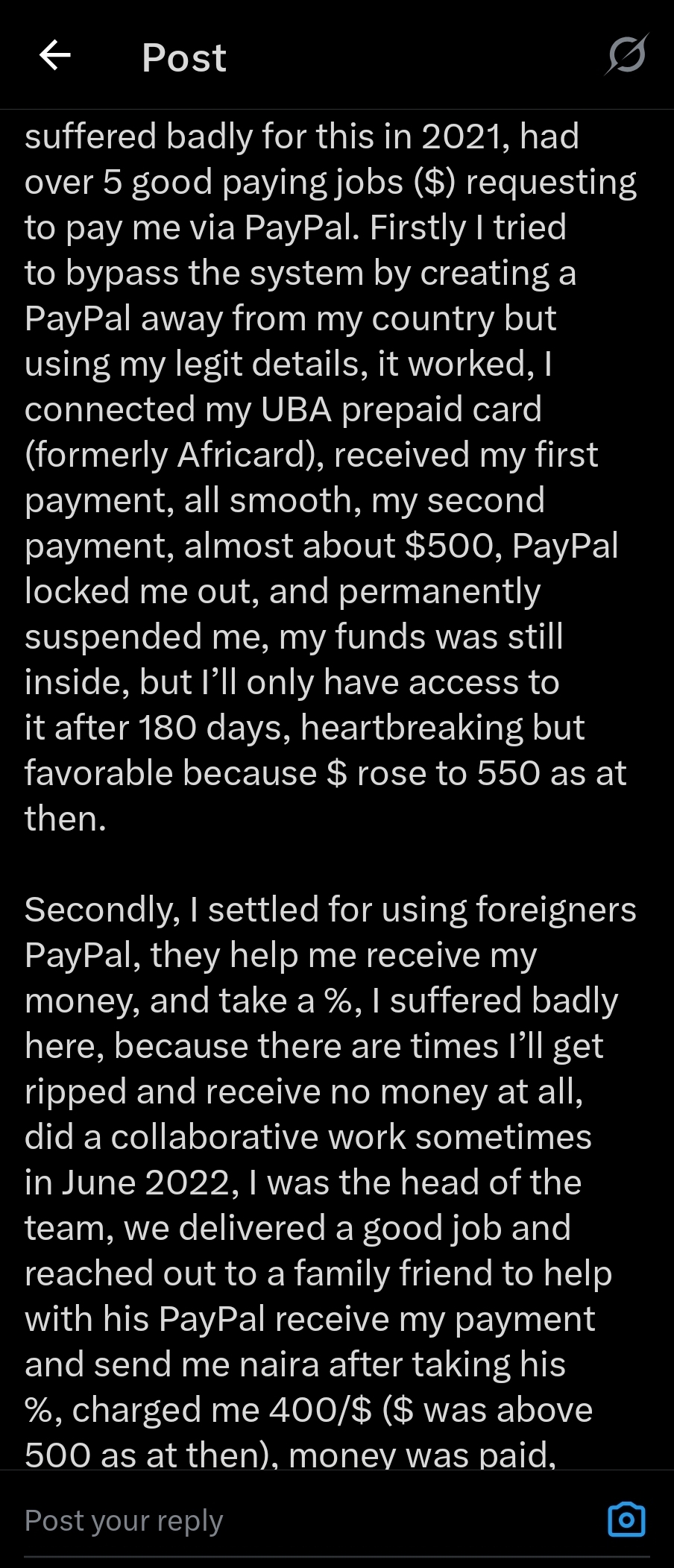

For many freelancers, online sellers, and remote workers, this meant resorting to informal workarounds, middlemen, or alternative fintech platforms — often at extra cost, risk, and delay.

Social Media Backlash: Not “Welcome Back” — But “Too Late”

Instead of thanking PayPal for re-entering the market, many Nigerians on X and other platforms posted strong criticisms.

Some of the common sentiments included:

Reminders of years of exclusion: Posts highlighted how PayPal “locked Nigerians out of the global digital economy for more than 20 years.”

Criticism that the return is “too little, too late”: Users argued that Nigeria’s fintech ecosystem — including homegrown giants like Flutterwave, Paystack, and Paga itself — already filled the gaps that PayPal once ignored.

Calls for boycott or mistrust: Some users explicitly said PayPal should not be embraced, citing past losses and distrust of the company’s intentions.

“Quiet return” rhetoric: Multiple posts described PayPal’s strategy as trying to slip back into the African market “like nothing happened,” rather than apologising or engaging with the community.

These reactions reflect not just disappointment with PayPal’s long absence, but resentment — especially among those who lost money, opportunities, or earnings because of limits on inbound payments.

Mixed Views: Some See Value, Others Distrust the Move

Not all reactions were negative. A faction of Nigerians did see value in gaining formal access to the world’s largest payments network, especially for those needing reliable cross-border income and shopping options.

But the loudest voices — and the ones trending on social media — questioned PayPal’s motives, highlighted past harm, and argued that:

PayPal’s late re-entry doesn’t erase lost opportunities.

Nigerians have already built strong alternatives that serve similar needs.

Trust, once broken, is not easily repaired — especially in financial services.

A Turning Point for the Nigerian Fintech Narrative?

Whether this backlash influences PayPal’s future strategy in Nigeria remains to be seen. But the conversation itself reveals something important:

Nigerian tech users are no longer passive consumers — they demand accountability, institutional memory, and voice in how global platforms operate locally.

PayPal’s return, even if technically beneficial to many users, reopened old wounds — and sparked a broader debate about who really owns economic opportunity in Nigeria’s digital economy.

Share on Facebook «||» Share on Twitter «||» Share on Reddit «||» Share on LinkedIn