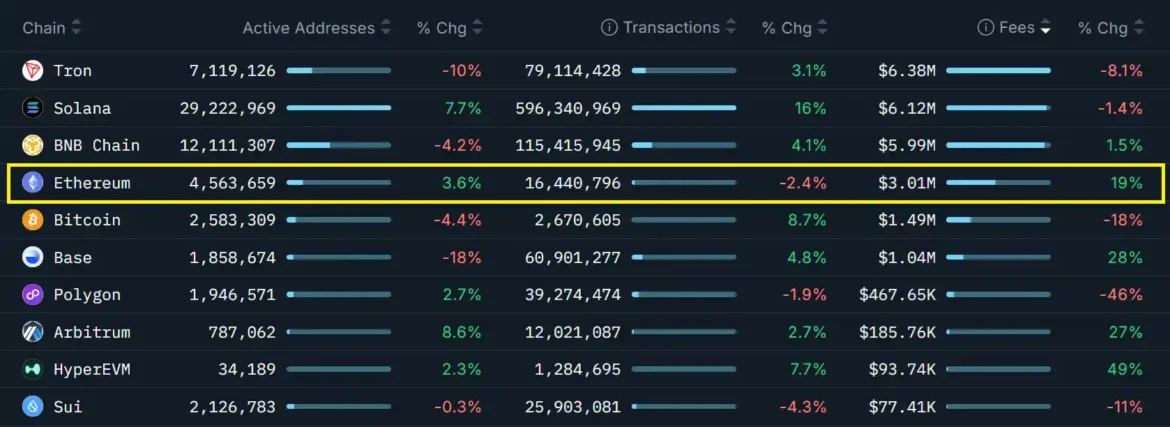

Ethereum quietly pulled off something that critics said wouldn’t last: it processed about 16.4 million transactions in a single week while keeping average fees under $0.20.

That matters because it shows the network can handle real demand without punishing users on costs, even during busy periods.

For a chain often accused of being too expensive, this week told a different story.

Trading Frenzy Meets a Sudden Price Jolt

While onchain activity surged, ETH’s price went the other direction—at least temporarily.

Over the seven days ending Sunday, Ether slid 15.9%, setting off roughly $910 million in liquidations tied to leveraged bullish bets.

That sharp move rattled traders and revived worries that the $2,800 support zone, which has held for two months, might finally give way.

Still, the sell-off hasn’t completely crushed optimism, as several indicators hint at a bounce toward the $3,300 area.

Why Fees and Transactions Still Matter Most

When it comes to judging real demand for a blockchain, fees paid to the base layer are still king—right alongside transaction counts and active addresses.

Ethereum has taken heat for leaning hard into rollups instead of keeping everything on the main chain.

But that bet is starting to look smart.

Activity on Base, Polygon, Arbitrum, and Optimism is climbing fast, showing that scaling out doesn’t have to mean losing relevance.

Layer-2s Push Ethereum Past Rivals

Over the past week, Ethereum’s network fees jumped 19%, while competitors like Tron and Solana saw softer numbers compared with their recent averages.

The bigger headline, though, is volume: Ethereum layer-2s combined for about 128 million transactions, topping both BNB Chain and Tron.

In plain terms, Ethereum is proving it can grow without breaking its core economics.

DEX Activity Signals Capital Is Flowing Back

Decentralized exchange usage is often the first place fresh capital shows up—and Ethereum is seeing it again.

Although perpetual futures trading peaked back in August 2025, the tide has started shifting back toward ETH-based platforms.

One big reason: average transaction fees have fallen sharply, from $0.50 last November to around $0.20 now, making active trading far less painful.

Volumes Climb as Upgrades Pay Off

Weekly DEX volume on Ethereum alone has climbed to roughly $13 billion, up from $8.15 billion just a month ago.

Solana still leads with about $30 billion weekly, but when you count the entire Ethereum ecosystem, total volume hits $26.8 billion—not far behind.

Much of that momentum traces back to the Fusaka upgrade in December 2025, which expanded data capacity and introduced batch transactions, smoothing out the user experience.

Ethereum’s Grip on DeFi Remains Strong

Despite louder competition, Ethereum continues to dominate total value locked (TVL).

That staying power suggests investors still lean toward Ethereum’s decentralization model, even as BNB Chain and Solana try to claw away market share.

For many builders and users, Ethereum remains the default home for serious DeFi activity.

Options Traders Ease Off the Panic Button

In derivatives markets, sentiment is stabilizing.

After several days of traders loading up on protective puts, the balance between calls and puts has leveled out.

Interestingly, the heaviest put activity actually came after ETH dipped below $2,800, not before.

As concerns around a potential US government funding shutdown faded, traders appear more comfortable sitting neutral rather than bracing for another leg down.

Macro Headwinds Haven’t Fully Cleared

Zooming out, Ether’s recent weakness stands in contrast to traditional markets.

The S&P 500 is hovering within half a percent of its all-time high, and 5-year US Treasury yields have steadied near 3.85%. Even so, investors are still wary about inflation and recession risks. Expectations for rate cuts have cooled too—the chance of the Fed lowering rates to 3.25% or below by July has dropped sharply over the past month.

What Could Push ETH Higher From Here

Looking ahead, a move toward $3,200–$3,300 likely depends on a few things lining up: continued strength in DEX activity, steadily rising network fees, and calmer options markets as recent uncertainty fades.

If those pieces hold, Ethereum’s recent dip may end up looking more like a pause than a breakdown.

Final Note for Readers

This article is for informational purposes only and does not offer investment advice.

Crypto markets are volatile, and every decision carries risk. Readers should do their own research before making any financial moves.

While care has been taken to present accurate information, no guarantees are made regarding completeness or reliability, and no liability is assumed for actions taken based on this content.

What’s Next?

All eyes now turn to whether Ethereum can turn its surge in usage into sustained price momentum—or if another wave of volatility is waiting just around the corner.

Share on Facebook «||» Share on Twitter «||» Share on Reddit «||» Share on LinkedIn