As global economic uncertainty continues to ripple through markets, businesses, and households, Canada’s new government is turning its focus inward.

Rather than trying to control the uncontrollable, officials are aiming to strengthen the domestic economy and make daily life more affordable for Canadians.

While big-picture gains may take time, the government recognizes that families need relief now.

Immediate Relief for Rising Grocery Costs

Food prices have been rising steadily, and many Canadians are feeling the squeeze.

To help, the government is introducing the Canada Groceries and Essentials Benefit, designed to support over 12 million low- and modest-income Canadians starting in spring 2026, pending Royal Assent.

The goal is simple: make day-to-day essentials more accessible without waiting for long-term economic plans to take effect.

How the Benefit Will Work

The new benefit builds on the existing Goods and Services Tax (GST) Credit and will deliver $11.7 billion in support over six years. It does this in two main ways:

-

One-Time Top-Up in Spring 2026 – Eligible recipients will receive a one-off payment, representing a 50% increase over the 2025-26 GST Credit. This will funnel $3.1 billion in immediate assistance to individuals and families.

-

Long-Term Increase Starting July 2026 – The Canada Groceries and Essentials Benefit will see a 25% boost for five years, adding $8.6 billion in support and extending assistance to 500,000 additional Canadians.

What This Means for Families

For a clearer picture, the new payments could provide up to $402 extra for a single adult, $527 for a couple, and $805 for a couple with two children.

These amounts are intended to offset grocery cost increases that have outpaced overall inflation since the pandemic.

After the one-time top-up, the enhanced regular payments will kick in from July 2026 and continue quarterly — in July, October, January, and April — giving families predictable support for everyday expenses.

These benefits are on top of other programs like the Canada Child Benefit, Canada Disability Benefit, and Guaranteed Income Supplement.

Real-World Examples

To put numbers into context:

-

Single Senior – A senior earning $25,000 would receive a one-time top-up of $267 plus $136 in longer-term support for 2026-27, totaling $402 extra. Including the base benefit, they would see $950 for the year.

-

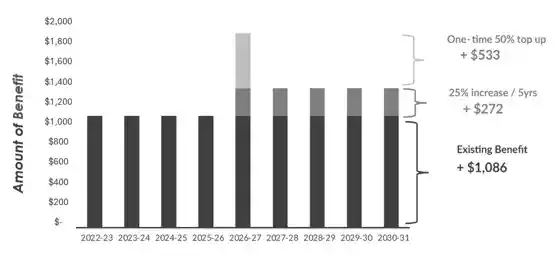

Family of Four – A couple with two children earning $40,000 would get a $533 top-up and $272 increase for the year, totaling $805 in additional support. With the base benefit included, their total comes to $1,891 for 2026-27.

| Family Type | Base 2026-27 Amount | 50% Top-Up | 25% Increase | Total Increase | Total Benefits Received |

|---|---|---|---|---|---|

| Single | $543 | +$267 | +$136 | $402 | $950 |

| Couple, 2 kids | $1,086 | +$533 | +$272 | $805 | $1,891 |

Assuming Royal Assent by March 31, 2026.

Figures may vary slightly due to rounding.

Getting the Payments

Recipients won’t need to apply separately.

Payments will automatically go to current GST Credit recipients once eligibility is confirmed.

Canadians just need to ensure their 2024 tax return is filed to receive the spring top-up and must file their 2025 tax return to continue receiving the enhanced benefit from July 2026.

Looking Ahead

Legislation to enact the one-time top-up and the five-year increase will be tabled in the coming weeks.

Once approved, these payments will provide meaningful, ongoing support to millions of Canadians while the government continues to work toward its broader goal: building the strongest economy in the G7.

Share on Facebook «||» Share on Twitter «||» Share on Reddit «||» Share on LinkedIn