At the start of 2025, few people would have bet on Bybit staging any kind of comeback.

The exchange was still reeling from a massive February security breach that wiped out $1.5 billion worth of Ether — the largest crypto hack on record.

And yet, by the time the year wrapped up, Bybit had quietly clawed its way back into the big leagues.

According to CoinGecko, it ended 2025 as the second-largest crypto exchange by trading volume, a result that surprised even seasoned market watchers.

From Crisis to Comeback Numbers

CoinGecko data shows Bybit processed about $1.5 trillion in trades across 2025, giving it an 8.1% slice of the global exchange market.

Research analyst Shaun Paul Lee described the recovery as slow but steady, noting that despite the February disaster, the platform gradually rebuilt momentum and user activity throughout the year.

In a market where confidence can evaporate overnight, that kind of consistency mattered.

The Hack That Should Have Ended It

The February attack wasn’t just another exchange breach.

Investigators linked it to North Korean hackers who exploited weaknesses in Bybit’s cold wallet system, making off with $1.5 billion in ETH.

History suggests that blows like this are usually fatal.

Immunefi CEO Mitchell Amador previously pointed out that nearly 80% of hacked crypto projects never fully bounce back, largely due to broken trust and operational chaos during the aftermath.

Why Users Didn’t Flee

Bybit’s response helped change that script.

Instead of freezing activity, the exchange kept withdrawals open and honored all user transactions.

CEO Ben Zhou went public quickly, appearing on camera to calm nerves and explain the situation.

He assured customers that Bybit had enough reserves to cover losses and would secure extra liquidity from external partners if needed.

That transparency, paired with uninterrupted access to funds, seems to have convinced many users to stick around.

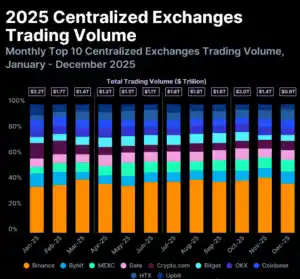

Trading Volumes Rose Almost Everywhere

Bybit wasn’t alone in benefiting from a more active market.

CoinGecko’s report shows that six of the top 10 exchanges increased their trading volumes in 2025.

On average, volumes across these platforms rose by 7.6%, translating to roughly $1.3 trillion in additional trades over the year.

Despite a slower finish, the broader crypto market had plenty of fuel, with Bitcoin and other major assets hitting multiple all-time highs.

MEXC’s Explosive Growth Story

Among all exchanges, MEXC stood out as the fastest climber.

Its trading volume surged 91% year-on-year, jumping from $766.7 billion in 2024 to about $1.5 trillion in 2025.

CoinGecko attributes much of this growth to MEXC’s aggressive zero-fee strategy on spot trades, which proved irresistible to both high-frequency traders and everyday retail users.

Binance Still Leads, Even With a Dip

At the top of the leaderboard, Binance remained firmly in first place.

CoinGecko estimates the exchange handled around $7.3 trillion in trades during 2025.

That said, it didn’t grow year-on-year — volumes actually slipped by about 0.5% compared to 2024.

Shaun Paul Lee linked that decline to broader bearish sentiment following a major market liquidation event on October 10.

A Bigger Picture Beyond Volumes

Despite the slight slowdown in trading activity, Binance continued expanding its footprint.

In a December open letter, co-CEOs Richard Teng and Yi He revealed that the platform’s user base had surpassed 300 million.

They also disclosed that total trading volumes across all Binance products reached a staggering $34 trillion for the year, underscoring its continued dominance.

What This Year Really Showed

Taken together, 2025 highlighted just how resilient — and unpredictable — the crypto exchange landscape can be.

Bybit’s recovery proved that a well-handled crisis doesn’t always spell the end, while rapid risers like MEXC showed how pricing strategies can reshape market share.

Even established giants like Binance felt the mood swings of the market.

In crypto, survival isn’t just about avoiding disasters — it’s about how you respond when they hit.

Share on Facebook «||» Share on Twitter «||» Share on Reddit «||» Share on LinkedIn