On the surface, Avalanche’s fourth quarter looked rough if you were only watching the price chart. AVAX slid hard, trailing far behind Bitcoin and Ether.

But underneath that price action, something very different was happening.

Big institutions were showing up, real money was moving on-chain, and Avalanche’s real-world asset ecosystem quietly hit a record high.

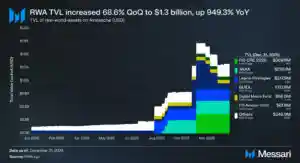

Real-World Assets Surge to a New Peak

By the end of Q4 2025, the total value locked in tokenized real-world assets on Avalanche had climbed past $1.3 billion.

That’s a massive jump—up nearly 69% in just one quarter and close to 950% over the full year.

According to Messari analyst Youssef Haidar, this growth was fueled largely by institutional-grade products finally going live on the network.

BlackRock’s BUIDL Fund Changes the Scale

The biggest catalyst came in November with the launch of BlackRock’s USD Institutional Digital Liquidity Fund, better known as BUIDL.

The $500 million tokenized money market fund landed directly on Avalanche and immediately shifted the conversation.

This wasn’t a pilot or a small experiment—it was one of the world’s largest asset managers deploying serious capital on-chain.

Tokenized Loans Bring Banks Into the Picture

Avalanche also made progress in tokenized credit markets.

Fintech heavyweight FIS partnered with Avalanche-based marketplace Intain to roll out tokenized loans.

Through Intain’s infrastructure, roughly 2,000 U.S. banks can now securitize more than $6 billion in loans directly on Avalanche, adding another real-world use case that goes far beyond crypto-native finance.

Wall Street Indices Go On-Chain

Traditional market data is also finding its way onto Avalanche.

S&P Dow Jones teamed up with Dinari to launch the S&P Digital Markets 50 Index on the network.

The index tracks a mix of 35 crypto-related stocks and 15 crypto tokens, bringing familiar financial benchmarks into a blockchain-native format.

Regulators Loosen the Reins on Innovation

This wave of experimentation hasn’t happened in a vacuum.

Traditional finance firms have become more comfortable testing tokenization as regulators signal openness to new crypto products.

Under SEC leadership over the past year, the tone has shifted toward cautious innovation rather than outright resistance.

Avalanche ETFs Add to Institutional Momentum

That regulatory shift showed up in filings as well.

Asset managers Bitwise and VanEck submitted S-1 applications late last year for spot Avalanche ETFs that include staking.

VanEck’s version officially launched earlier this week, giving investors another regulated pathway into the Avalanche ecosystem—even as the token price struggles.

AVAX Price Continues to Lag the Market

Despite all that activity, AVAX had a brutal quarter.

The token dropped 59% in Q4, falling to about $12.30, and has slipped another 10% so far in early 2026.

Compared to Bitcoin and Ether—both of which hit fresh all-time highs this cycle—Avalanche has clearly been left behind.

A Long Way From the 2021 Highs

The contrast is stark. AVAX is still more than 92% below its November 2021 peak of $144.96, according to CoinGecko.

While fundamentals on the network are improving, the market hasn’t rewarded that progress yet.

DeFi Activity Tells a More Optimistic Story

Zooming in on on-chain data paints a brighter picture.

Avalanche’s native DeFi ecosystem grew steadily in Q4, with the value locked rising 34.5% to nearly 97.5 million AVAX.

At the same time, average daily transactions jumped 63%, reaching about 2.1 million per day—clear signs of increasing network usage.

Stablecoins Hold Steady as USDT Takes the Lead

Stablecoin activity was mostly flat, with total market cap on Avalanche’s main chain ticking up just 0.1% to $1.741 billion. The big shift was in dominance.

Tether’s USDT overtook USDC to become the leading stablecoin on Avalanche, ending the year with $736.6 million in circulation and more than 42% of total supply.

Price vs Progress: Avalanche’s Split Reality

Avalanche’s Q4 story is a study in contrast.

The token price struggled, but institutional adoption, real-world assets, and on-chain activity all moved sharply higher.

Whether the market eventually catches up to that progress is still an open question—but the groundwork is clearly being laid.

Share on Facebook «||» Share on Twitter «||» Share on Reddit «||» Share on LinkedIn