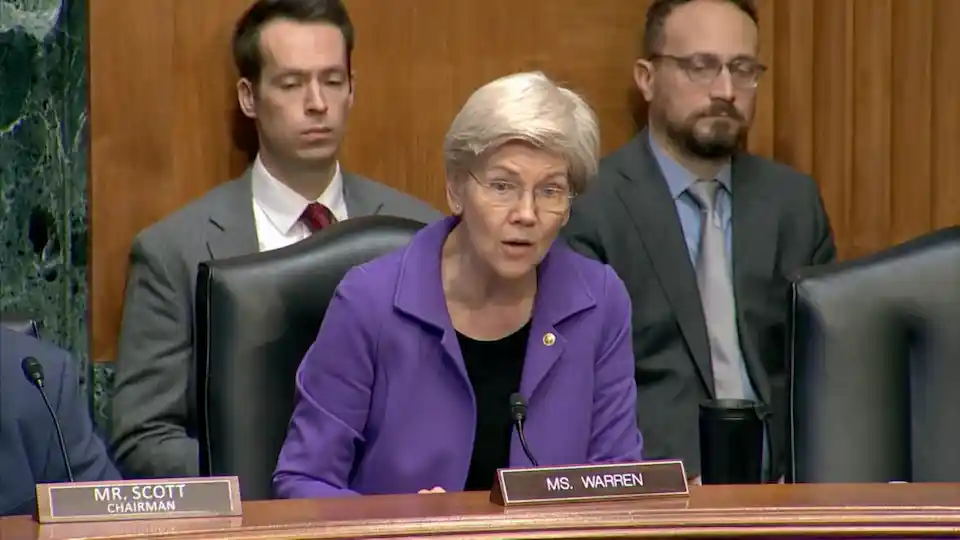

US Senator Elizabeth Warren is publicly pushing back against a controversial proposal involving World Liberty Financial — a crypto venture with close ties to President Donald Trump and his family.

Warren wants the country’s top banking regulator to pause its review of the company’s bid for a national bank charter until Trump completely cuts his financial ties to the platform.

What Triggered Warren’s Letter

On Tuesday, Warren sent a strongly worded letter to Jonathan Gould, the Comptroller of the Currency at the Office of the Comptroller of the Currency (OCC), urging him not to move forward with World Liberty Financial’s application for a trust bank charter.

She argues that allowing the OCC to consider the bid while Trump still retains a financial stake in the company would present a historically unprecedented conflict of interest.

The OCC is currently reviewing a charter request from WLTC Holdings, a subsidiary of World Liberty that wants to form the World Liberty Trust Company.

If approved, it would be licensed to issue, custody, convert, and manage the firm’s stablecoin, called USD1.

Warren Says Trust Is at Stake

Warren didn’t mince words in her letter: she says there’s “no confidence” that the OCC will evaluate the application fairly given Gould’s previous responses to questions about guarding against presidential influence.

In her view, letting a sitting president have any role — direct or indirect — in a business that his own appointees regulate is simply too much.

She reminded Gould that under the GENIUS Act — the law that designates the OCC as the lead regulator for stablecoin issuers — the bureau would be drafting rules that affect profitability and supervision of companies like World Liberty.

That means the Comptroller could be enforcing regulations against a firm tied financially to the president while serving at his pleasure.

Warren says this dynamic undermines the integrity of the entire banking regulatory system.

The Trump Family’s Involvement

World Liberty Financial’s stablecoin USD1 has grown rapidly since its launch, and the company’s filing for a national trust bank charter marks a significant step in its evolution.

The platform has generated billions in assets and, by extension, paper wealth for the Trump family and other founders.

Warren pointed out that both Trump and his sons — Barron, Eric, and Donald Trump Jr. — are listed as co‑founders of the venture, and that the family stands to benefit financially if the charter is approved.

This is the core of her ethical concern: a president overseeing rules that could affect his own business interests.

Clash Over Crypto Oversight

The battle over the charter is playing out against the backdrop of broader debates over how to regulate stablecoins and the crypto industry.

The GENIUS Act, signed into law last year, established a federal framework for stablecoin regulation and made the OCC the primary licensing authority for issuers like USD1.

But critics, led by Warren, argue that the law didn’t go far enough to prevent conflicts like this one from arising.

Warren also highlighted ongoing negotiations in the Senate over a crypto market structure bill.

Her letter stressed that the draft bill lacks conflict‑of‑interest protections that Democrats have been pushing for — an omission she says could worsen the problem if left unaddressed.

What Warren Wants Next

Warren’s demand is clear: she wants the OCC to delay reviewing World Liberty’s charter application until Trump and his family divest from the company and eliminate any financial conflicts of interest.

She set a January 20 deadline for a written response from Gould.

This request comes as the Senate Banking Committee prepares to debate new crypto legislation, and as policymakers continue wrestling with how to balance innovation in digital assets against ethical safeguards in financial oversight.

Stakes for Regulation and Trust

This clash highlights a deeper trust issue: regulators are being asked to police an industry that is increasingly linked to powerful political figures.

For Warren, the risk is not just about one company’s application — it’s about making sure that the public has faith in a system where no president, current or future, can be seen as regulating his own business interests.

With negotiations over crypto market structure legislation still underway and pressure mounting on the OCC, this story is far from over.

How regulators and Congress respond could shape the future of crypto oversight in the US — and whether conflict‑of‑interest safeguards become a central part of that future.

Share on Facebook «||» Share on Twitter «||» Share on Reddit «||» Share on LinkedIn