The future of Thames Water, Britain’s largest water supplier serving 16 million customers in London and the Thames Valley, could be decided in just a few weeks.

With the utility struggling under £17 billion of debt, Ministers are reportedly preparing to effectively nationalise the company temporarily before putting it up for sale.

Asian Tycoon Emerges as Front-Runner

CK Infrastructure (CKI), a firm already owning Northumbrian Water, has signalled its readiness to step in if Thames Water enters special administration.

This would make CKI the likely front-runner in a potential bidding war for the beleaguered utility.

CKI’s parent company, CK Hutchison Holdings (CKH), is a global conglomerate with interests spanning pub chains, container ports, retail stores, and infrastructure worldwide.

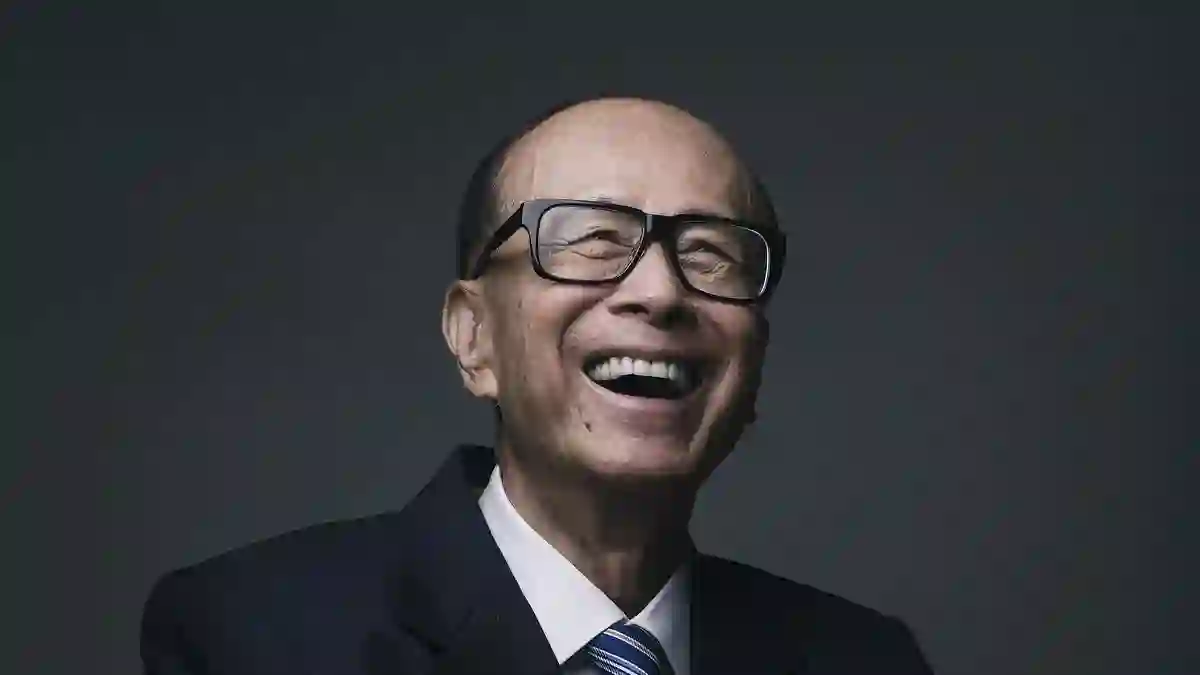

Li Ka-Shing: The Man Behind the Empire

At the heart of CKH is 97-year-old Li Ka-Shing, Hong Kong’s most successful tycoon, often nicknamed ‘Superman’ for his sharp business instincts.

Li, who arrived in Hong Kong in 1940 as a 12-year-old refugee from the Sino-Japanese war, remains an active force in the business even after stepping down as chairman in 2018.

Twice a week, he continues to visit the office, while also supporting philanthropic projects such as the £142 million Tsz Shan Monastery.

CKH’s Expanding UK Portfolio

CKH’s British operations are extensive. The company owns Greene King pubs, retailer Superdrug, and UK Power Networks, which manages the electricity grid across London and the South-East.

It previously owned mobile network Three, now merged with Vodafone, giving CKH a near 50% stake in the new telecom giant.

CKH’s UK profits have surged in recent years, thanks to contributions from Northumbrian Water, its electricity grid, and gas networks.

Rising Profits Despite Global Headwinds

CKH’s half-year results show an 11% rise in underlying profits to £1.1 billion, even as overall profits fell sharply due to the Vodafone-Three merger.

Despite challenges, including tensions from Donald Trump’s trade war with China and previous clashes with Beijing over Hong Kong politics, CKH continues to reward shareholders.

Li himself collected a £72 million dividend in the latest reporting period.

Concerns Over Foreign Control

The potential acquisition of Thames Water by a company linked to a Chinese tycoon has sparked unease among politicians and industry observers.

Former Tory leader Iain Duncan Smith warned of the risks of giving a foreign-controlled company influence over critical national infrastructure. Similar concerns have even been raised in the US Congress.

CKH Offers Environmental Assurances

To alleviate concerns, CKH has reportedly agreed to abide by stricter environmental rules for Thames Water, including tougher fines for regulatory breaches.

Senior hedge fund creditors, who previously doubted the financial viability of such measures, are now reportedly supportive of CKH as a long-term infrastructure owner.

Ministers Hope Superman Can Deliver

With Thames Water sinking under debt and few alternatives on the table, the government may overlook CKH’s Chinese ties.

After decades of building a global empire, Hong Kong’s ‘Superman’ could be the very person to stabilise Britain’s largest water utility, ensuring continued service for millions while preparing the company for its next chapter.