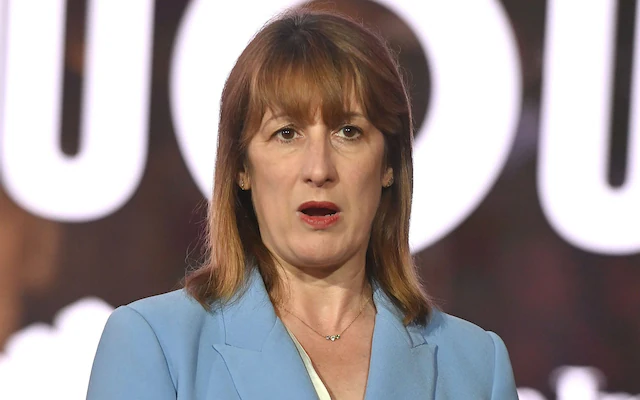

Labour is reportedly considering a major shake-up of the property market, with Chancellor Rachel Reeves exploring plans that could make selling a home liable for capital gains tax.

Sources describe it as a potential “mansion tax,” aimed at higher-value properties, which could end the long-standing exemption that homeowners currently enjoy.

How the Tax Could Work

Under the proposals, those paying higher-rate income tax could face 24% on any profit made from selling their property, while basic-rate taxpayers might pay 18%.

The so-called “private residence relief,” which protects homeowners from paying capital gains tax on their main property, could be removed for certain properties, with the threshold reportedly under discussion.

Estimates suggest a £1.5 million threshold would affect around 120,000 higher-rate taxpayers, leaving them with capital gains bills averaging nearly £200,000.

Concerns for Pensioners and Homeowners

Property experts have warned that this move could disproportionately impact pensioners looking to downsize.

Many long-term homeowners have seen their property values soar over decades, and taxing these gains might make it financially difficult for them to move.

Critics say this could slow down the housing market and reduce the funds the Treasury hopes to raise.

Private Residence Relief Explained

Currently, homeowners don’t pay capital gains tax if:

- They have only one home, used as their main residence.

- They haven’t rented out part of the property (lodgers don’t count).

- No part of the home has been used exclusively for business purposes.

- The property, including grounds and outbuildings, is under 5,000 square meters.

- The home wasn’t purchased solely to make a profit.

If these conditions apply, homeowners automatically benefit from private residence relief, paying no tax when they sell.

Expert Reactions

Aneisha Beveridge of Hamptons warned that the £1.5 million threshold could create a sharp “cliff edge,” discouraging sales just above that mark.

Tom Bill from Knight Frank noted that, especially in central London, property prices have fallen over the last decade, which could limit potential gains and reduce revenue.

Simon Brown of Landmark Information Group added that discouraging downsizing could shrink the overall housing market, hitting first-time buyers and the Treasury alike.

Labour’s Previous Stance

This isn’t the first time Labour has faced questions about capital gains tax on homes.

Ahead of the 2024 general election, the party strongly denied any plans to introduce it.

Leader Sir Keir Starmer assured the public that capital gains tax would not apply to primary residences, emphasizing it was never part of Labour’s policy.

Wider Property Tax Controversy

Reeves is also reportedly exploring changes to stamp duty and council tax, potentially replacing them with an annual property levy for homes over £500,000.

While intended to encourage downsizing and open up the market, critics—including TV presenter Kirstie Allsopp—warn that any new tax could destabilize the market and unfairly punish homeowners who have worked hard to secure their property.

Government Response

Treasury officials have remained non-committal.

Ministers say any decisions will be announced in the Budget, with a focus on working people’s incomes.

A Treasury spokesperson highlighted that economic growth, rather than new taxes, is the priority, citing planning reforms expected to generate billions in growth while keeping borrowing under control.

What’s Next

The coming months could see further clarity when the Chancellor unveils her autumn Budget.

Analysts and homeowners alike are watching closely, weighing the potential impact on the housing market, pensioners, and the wider economy.

With both political and financial stakes high, this is shaping up to be one of the most closely scrutinized Budget proposals in recent memory.