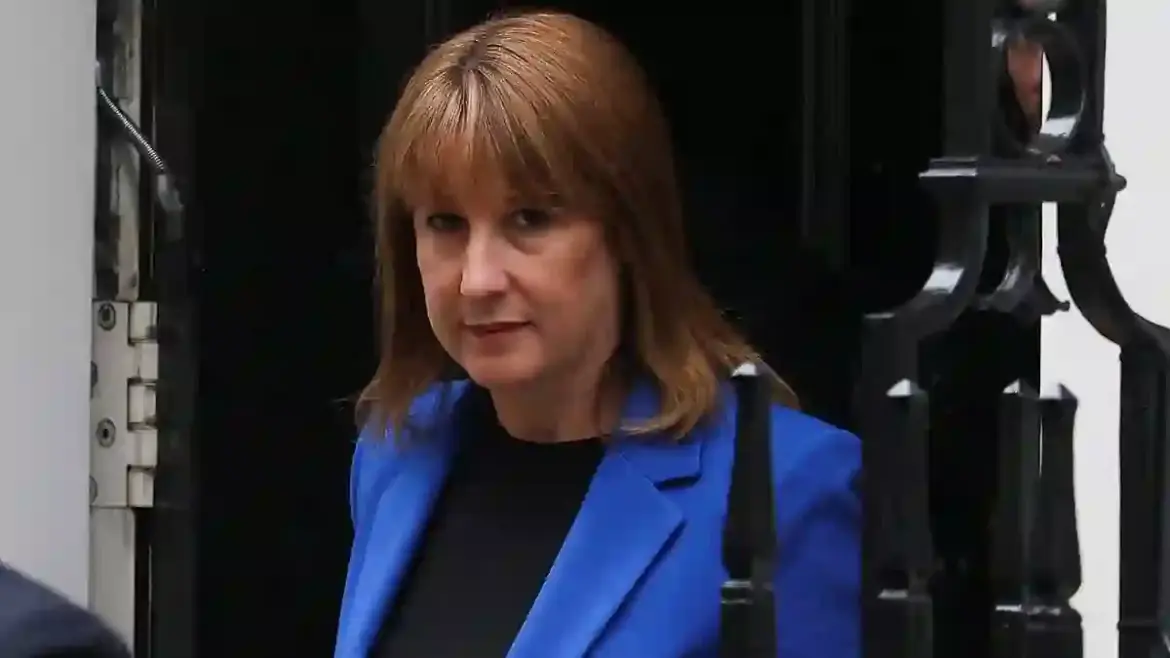

Chancellor Rachel Reeves is facing growing pressure as speculation swirls around her second Budget, which has now been confirmed for November 26.

With talk of a potential £50 billion gap in the nation’s finances, she’s working hard to convince both the public and the markets that Britain is not heading into a crisis.

Speculation Over Tax Hikes

Rumors have been flying about what Reeves might announce this autumn.

Ideas being floated include scrapping capital gains tax exemptions on certain property sales, new landlord levies, or even swapping stamp duty for an annual property charge.

Treasury insiders have also hinted at possible inheritance tax changes and the usual whispers about “sin taxes.”

But Reeves insists much of this is pure guesswork.

In a BBC interview, she pushed back against what she called “irresponsible” speculation, dismissing many predictions as “rubbish.”

Battling Reports of a Financial Black Hole

Adding fuel to the fire, a recent report from the National Institute of Economic and Social Research suggested that Reeves’ slim £9.9 billion “safety buffer” has evaporated, leaving a £41 billion deficit.

To restore stability, the think tank warned she would need to find £51 billion each year by 2030—through tax rises or spending cuts.

Reeves, however, was quick to counter, saying the institute’s figures had been “wrong more often than most” in recent years.

Market Jitters and Rising Debt Costs

The Chancellor’s challenge became even more urgent after interest rates on UK government bonds hit levels not seen in nearly three decades.

Investors fear Britain will have to borrow more, driving yields on long-term gilts higher and making debt more expensive to manage.

Reeves tried to calm nerves by stressing her commitment to fiscal rules and reminding voters that inflation and borrowing costs can only come down if the government keeps a tight lid on spending.

A Budget Date That Raises Eyebrows

Announcing the Budget for November 26—later than many had expected—Reeves has bought herself more time to prepare.

But critics argue the delay only fuels “damaging uncertainty” for businesses.

Even within her own party, there are whispers of unease.

Former Chancellor Ken Clarke went so far as to suggest Britain could be edging towards the kind of financial crisis that forced Labour to turn to the IMF in the 1970s.

Critics Warn of a “Doom Loop”

Economists warn that Reeves cannot rely solely on raising taxes to fill the gap.

Piling more costs on households and businesses, they argue, risks choking off growth and triggering a cycle where ever-higher taxes are needed to patch the shortfall.

As one financial analyst put it, investors are already betting the government will need to issue more debt, creating a “slow-moving vicious cycle.”

Reeves’ Reassurances

Despite the gloomy forecasts, Reeves insists Britain’s economy is “not broken” but admits it is “not working well enough for working people.”

She highlighted her priorities: tackling high bills, supporting growth, and reforming planning rules to unlock housebuilding targets.

Trade deals with the US, India, and the EU, alongside reforms to boost productivity, were presented as evidence of progress.

“More pounds in your pocket, an NHS there when you need it, opportunity for all,” Reeves said in a video message, framing her mission as one of renewal and fairness.

The Bigger Picture

While bond market turmoil has been described as a global phenomenon by Bank of England Governor Andrew Bailey, the UK has been hit particularly hard, partly due to stubbornly high inflation.

Some predict yields could even climb past 6% before the year ends.

This means Reeves’ upcoming Budget could prove one of the toughest in recent memory—balancing the books without derailing growth, all while managing public expectations.

What Comes Next

Between now and November, Reeves is expected to roll out a series of announcements on boosting productivity and growth.

But with the clock ticking and markets watching closely, she faces a delicate balancing act: calm fears, chart a credible fiscal path, and prove that Labour’s economic strategy can weather the storm.

Chancellor Rachel Reeves is facing growing pressure as speculation swirls around her second Budget, which has now been confirmed for November 26.

With talk of a potential £50 billion gap in the nation’s finances, she’s working hard to convince both the public and the markets that Britain is not heading into a crisis.

Speculation Over Tax Hikes

Rumors have been flying about what Reeves might announce this autumn.

Ideas being floated include scrapping capital gains tax exemptions on certain property sales, new landlord levies, or even swapping stamp duty for an annual property charge.

Treasury insiders have also hinted at possible inheritance tax changes and the usual whispers about “sin taxes.”

But Reeves insists much of this is pure guesswork. In a BBC interview, she pushed back against what she called “irresponsible” speculation, dismissing many predictions as “rubbish.”

Battling Reports of a Financial Black Hole

Adding fuel to the fire, a recent report from the National Institute of Economic and Social Research suggested that Reeves’ slim £9.9 billion “safety buffer” has evaporated, leaving a £41 billion deficit.

To restore stability, the think tank warned she would need to find £51 billion each year by 2030—through tax rises or spending cuts.

Reeves, however, was quick to counter, saying the institute’s figures had been “wrong more often than most” in recent years.

Market Jitters and Rising Debt Costs

The Chancellor’s challenge became even more urgent after interest rates on UK government bonds hit levels not seen in nearly three decades.

Investors fear Britain will have to borrow more, driving yields on long-term gilts higher and making debt more expensive to manage.

Reeves tried to calm nerves by stressing her commitment to fiscal rules and reminding voters that inflation and borrowing costs can only come down if the government keeps a tight lid on spending.

A Budget Date That Raises Eyebrows

Announcing the Budget for November 26—later than many had expected—Reeves has bought herself more time to prepare.

But critics argue the delay only fuels “damaging uncertainty” for businesses.

Even within her own party, there are whispers of unease.

Former Chancellor Ken Clarke went so far as to suggest Britain could be edging towards the kind of financial crisis that forced Labour to turn to the IMF in the 1970s.

Critics Warn of a “Doom Loop”

Economists warn that Reeves cannot rely solely on raising taxes to fill the gap.

Piling more costs on households and businesses, they argue, risks choking off growth and triggering a cycle where ever-higher taxes are needed to patch the shortfall.

As one financial analyst put it, investors are already betting the government will need to issue more debt, creating a “slow-moving vicious cycle.”

Reeves’ Reassurances

Despite the gloomy forecasts, Reeves insists Britain’s economy is “not broken” but admits it is “not working well enough for working people.”

She highlighted her priorities: tackling high bills, supporting growth, and reforming planning rules to unlock housebuilding targets.

Trade deals with the US, India, and the EU, alongside reforms to boost productivity, were presented as evidence of progress.

“More pounds in your pocket, an NHS there when you need it, opportunity for all,” Reeves said in a video message, framing her mission as one of renewal and fairness.

The Bigger Picture

While bond market turmoil has been described as a global phenomenon by Bank of England Governor Andrew Bailey, the UK has been hit particularly hard, partly due to stubbornly high inflation.

Some predict yields could even climb past 6% before the year ends.

This means Reeves’ upcoming Budget could prove one of the toughest in recent memory—balancing the books without derailing growth, all while managing public expectations.

What Comes Next

Between now and November, Reeves is expected to roll out a series of announcements on boosting productivity and growth.

But with the clock ticking and markets watching closely, she faces a delicate balancing act: calm fears, chart a credible fiscal path, and prove that Labour’s economic strategy can weather the storm.