For months, investors have been watching the Federal Reserve closely, and now it seems like the long-awaited shift may be on the horizon.

Fed Chair Jerome Powell dropped strong hints that an interest rate cut could be coming soon, and the markets reacted instantly with a surge.

Powell Sounds the Alarm

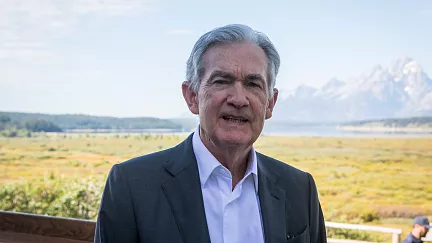

Speaking at the annual Jackson Hole Economic Policy Symposium in Wyoming, Powell didn’t sugarcoat the challenges ahead.

He admitted that the U.S. economy is losing momentum, with GDP growth slowing and unemployment numbers ticking upward.

This concern, he explained, may justify adjusting the Fed’s policy stance in the weeks ahead.

Wall Street Breathes a Sigh of Relief

Investors were quick to respond to Powell’s remarks.

The Nasdaq jumped nearly two percent, while the S&P 500 gained 1.4 percent.

Many on Wall Street now believe the Fed will vote for a quarter-point cut in September, which could help ease financial conditions and boost business confidence.

Risks Are Shifting

Powell made it clear that the balance of risks has changed.

Inflation risks remain on the upside, but the job market is showing signs of weakness.

If hiring continues to slow, the Fed may have little choice but to lower rates to keep the economy from stalling.

Expert Views on the Signal

Financial experts say Powell’s words carry weight.

Paul Stanley, Chief Investment Officer at Granite Bay Wealth Management, explained that investors have been rattled by the sharp slowdown in job growth.

Lower rates, he said, could give companies more breathing room to expand and hire again.

Why Rates Matter to Everyone

The Fed’s benchmark interest rates—currently between 4.25 and 4.5 percent—affect everything from mortgage payments to credit card interest to stock market valuations.

Even before official moves are made, markets react strongly to hints about where policy might be headed next.

The Jobs Data That Changed the Mood

July’s jobs report was the tipping point.

Non-farm payrolls added only 73,000 positions, far below the expected 100,000.

To make matters worse, the unemployment rate inched up to 4.2 percent, and earlier reports for May and June were revised downward by a combined 258,000 jobs.

Political Pressure in the Background

Adding to the drama, former President Donald Trump has been pushing Powell for months to slash rates, even going so far as to threaten his job.

But Wall Street views the Fed’s independence as crucial for financial stability, and any move to remove Powell could trigger chaos in the markets.

What Comes Next?

All eyes are now on September.

Will the Fed officially announce a rate cut, or will Powell hold off for more data?

One thing is clear—markets, businesses, and households are preparing for a shift that could shape the economy for months to come.