In a surprising turn of events, a little-known investment firm has quietly surged past the $1 billion mark in assets.

For a company that once flew under the radar, 1789 Capital is now commanding serious attention on Wall Street—and raising a few eyebrows along the way.

Small Team, Big Ambitions

1789 Capital, based in Palm Beach, Florida, lists just eight employees on its website.

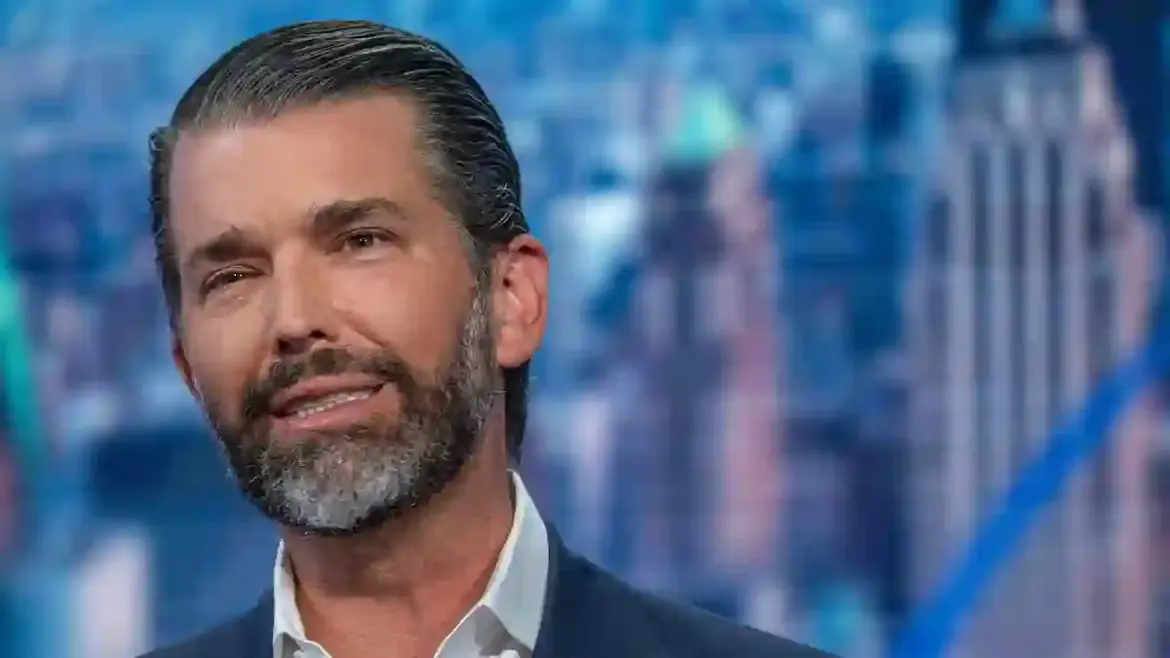

Among them is a familiar name: Don Trump Jr., the eldest son of former President Donald Trump.

What started as a small firm investing in conservative-leaning companies has evolved into a major player with high-profile investments across multiple sectors.

A Turning Point: November 2024

Before the 2024 election, 1789 Capital was relatively niche, placing modest bets in companies like Substack, Tucker Carlson’s media ventures, pharmaceutical firms, and AI startups.

That changed dramatically after President Trump’s re-election in November 2024.

Just days after the nomination, Don Jr. was named a partner—a move signaling the firm’s ambitions to expand its influence.

High-Stakes Investments

Since then, Reuters reports that the company has been regularly deploying between $5 million and $50 million into high-visibility investments.

Highlights include helping ring the market bell on GrabAGun’s IPO and backing the prediction platform Polymarket.

More recently, 1789 Capital has ventured into AI startups and defense contractors with potential ties to U.S. government contracts.

A Conservative Counterbalance

Omeed Malik, one of the firm’s founders and a prominent donor to Trump’s 2024 campaign, sees 1789 Capital as a conservative response to what he perceives as a progressive tilt in corporate America.

The firm emphasizes what Malik calls “EIG”—entrepreneurship, innovation, and growth—positioning it as an alternative to the ESG (environmental, social, and governance) investment trend, which peaked at $30.3 trillion in 2022.

“We felt that the private sector was actually becoming quite politicized,” Malik told Bloomberg.

“People and customers want to shop their values in some respects. Politics has entered into the boardroom, and that’s undeniable.

We’d like the other half of the country to have a seat at that table.”

Luxury and Tech Investments

1789 Capital’s portfolio spans a wide spectrum.

It has invested in a high-end DC nightclub called Executive Branch, offering memberships starting at $500,000 to create the “highest-end private club” in the city.

It has also poured money into several Elon Musk ventures—including SpaceX, xAI, and Neuralink—along with the controversial vape company Juul Labs.

Ethics Questions Loom

The firm’s rapid rise and its connections to the Trump family have sparked concerns among ethics experts.

The company’s name, referencing the year the U.S. Constitution went into effect, has raised eyebrows as critics question potential conflicts of interest.

“I don’t think the founders would have tolerated this in 1789—that’s the irony of it,” said Richard Painter, who served as a White House ethics lawyer under President George W. Bush.

So far, the White House, 1789 Capital, and representatives for Don Jr. have denied any wrongdoing.

Attempts to reach company representatives for comment have not been successful.