Bhutan has quietly moved more than $22 million worth of Bitcoin in recent days, highlighting how even state-backed crypto ventures aren’t immune to the market’s volatility.

The Himalayan kingdom, which began mining Bitcoin in 2019 through its state-owned enterprise, has seen its holdings and production shrink amid falling prices and rising mining costs.

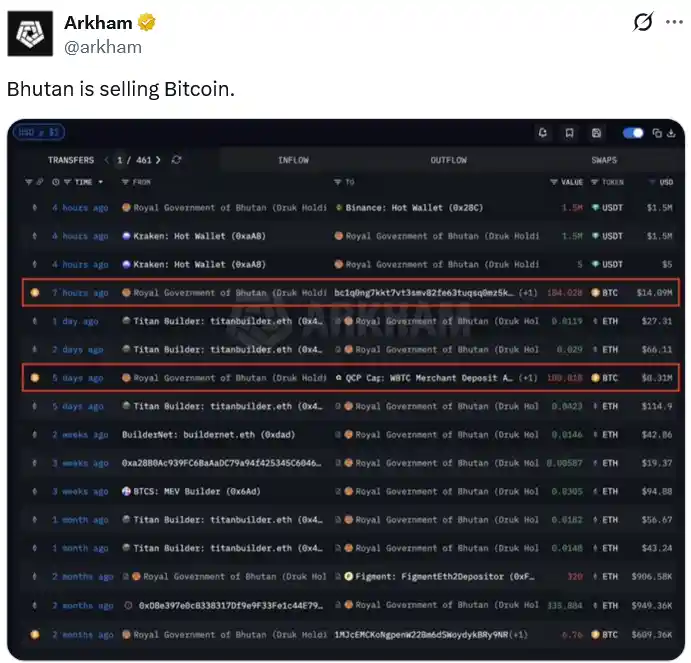

Recent Moves Show Significant Sales

Blockchain analytics firm Arkham reported that Bhutan transferred 184 BTC, worth about $14 million, from its national reserve on Wednesday.

This followed another transfer of 100.8 BTC, valued at $8.3 million, last Friday.

Both batches were sent to crypto market maker QCP Capital, a move that typically signals the intention to sell and convert Bitcoin into cash or other liquid assets.

Over the last week, these two transfers total $22.3 million, reflecting the country’s gradual offloading of digital assets as market conditions tighten.

Bhutan’s Bitcoin Journey and Mining Challenges

Since launching its Bitcoin operations, which rely mainly on hydroelectric power, Bhutan has accumulated roughly $765 million worth of Bitcoin.

At its peak in October 2024, the country held 13,295 BTC. That number has now dropped to around 5,700 BTC.

Mining efficiency has taken a hit as well.

Following the 2024 Bitcoin halving, the cost to mine a single Bitcoin has roughly doubled, and the kingdom is producing far fewer coins than the 8,200 BTC mined in 2023.

A Shift in Global Rankings

Bitcoin Treasuries data shows that Bhutan’s reduction in holdings has pushed it down to seventh place among nations, trailing the United States, China, the UK, Ukraine, El Salvador, and the UAE.

While the precise reasons for the recent sell-off are not publicly confirmed, Arkham notes that Bhutan tends to sell Bitcoin in batches of around $50 million, with the last major sale occurring in September 2025.

Druk Holding and Investments, the state entity managing Bhutan’s Bitcoin strategy, did not respond immediately when approached for comment.

Bitcoin Prices Take a Hit

The timing of Bhutan’s sales coincides with broader market weakness.

Bitcoin has fallen 42.8% from its all-time high of $126,080 in October 2025 to below $72,000, with investor sentiment dipping to levels last seen in mid-2022.

Multiple factors have contributed to this slump, including US government shutdowns, ongoing geopolitical tensions involving President Donald Trump’s trade and tariff threats, and stalled crypto market legislation in Washington.

Despite record global liquidity, investors are shifting toward safer assets like gold and silver.

Technical Concerns Add Pressure

Beyond macroeconomic issues, technical developments have added to the uncertainty.

Quantum computing is raising questions about Bitcoin’s long-term security, and the network’s hash rate has fallen below 1 zetahash per second as unprofitable miners shut down equipment.

These trends have fueled narratives about Bitcoin’s sustainability and profitability, particularly for smaller or state-backed miners.

What Lies Ahead for Bhutan

As Bitcoin continues to fluctuate and mining conditions remain challenging, Bhutan’s strategy may evolve further.

The kingdom has already shown it is willing to sell in stages to manage risk.

For now, the combination of global market pressures, technical challenges, and internal strategy adjustments will continue to shape the role of Bitcoin in Bhutan’s economic portfolio.