When it comes to long-term care, the bills just seem to keep climbing—and for families like mine, it’s been a financial rollercoaster.

Each year, the dreaded email from my uncle’s care home arrived, titled “Fee Review,” and without fail, the fees only went in one direction: up.

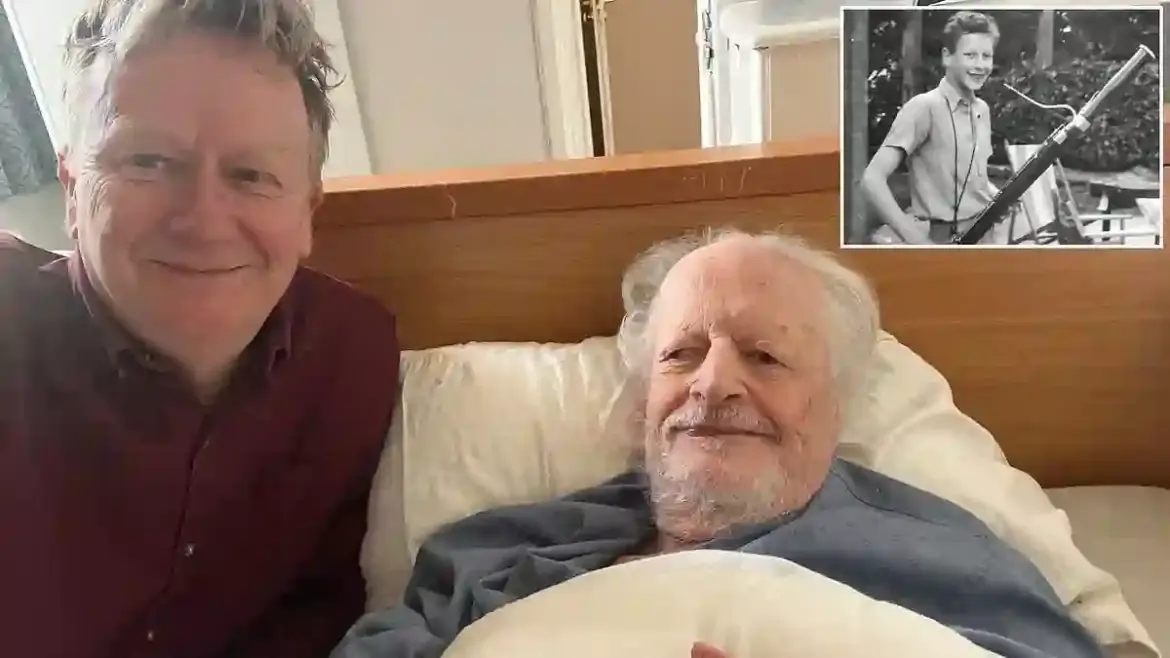

My Uncle’s Story

My uncle Richard had lived a secure life, owning his home outright and saving diligently.

But a catastrophic stroke in his late 50s changed everything. Suddenly, he needed full-time care, and the responsibility for his finances, initially handled by my father, fell to me.

I quickly realized that his savings were disappearing into what feels like a bottomless pit: care home fees.

Escalating Fees Over the Years

For years, he resided at Wellcross Grange in Horsham, West Sussex.

In 2020, his monthly payment was £3,410, offset partly by NHS-funded nursing care of £700–£800. Extras like haircuts and toiletries weren’t included.

By November 2020, the standing order jumped to £4,869, blamed on rising staff costs and COVID-19.

Over the next few years, fees continued to climb: £5,313, £6,047, £6,541, and finally, £7,500 this year.

In just five years, his monthly fees had more than doubled.

Justifying the Increases

The care home cited increased National Insurance contributions and changes in individual care needs.

When I asked for specifics, they mentioned “medication management and falls risk.”

If these needs were truly growing, my uncle might have qualified for NHS Continuing Healthcare, which covers care costs fully—but the home said his needs weren’t severe enough.

The Financial Burden

Half of the fees are covered by his state and private pensions plus Disability Living Allowance, the rest by his dwindling savings.

If fees keep rising at this rate, by 2030 he could face £16,500 a month—nearly £200,000 a year.

For most families, that’s impossible to sustain.

The Wider Picture

Unfortunately, my uncle isn’t alone. Of the roughly 400,000 UK residents in care homes, only half receive local authority or NHS financial support.

Residential care averages £5,164 per month, nursing care £6,180.

Age UK and other experts warn that ongoing cost-of-living pressures are draining savings faster than ever.

Finding a More Affordable Solution

After difficult discussions, we moved my uncle to a care home charging £1,500 less per month.

He’s happier, and the move bought a few extra years before his savings run out.

Still, when funds deplete, the local authority sets much lower fees, often requiring residents to move again.

Advice for Families

There are ways to plan ahead:

-

Seek financial advice early: A SOLLA-accredited adviser can help plan care costs, claim benefits like Attendance Allowance, and explore options such as equity release.

-

Register a Lasting Power of Attorney (LPA): This ensures someone you trust can make health and financial decisions if you’re unable.

-

Consider financial products: Immediate needs annuities provide monthly payments in exchange for a lump sum to cover care fees.

-

Engage local authorities: Ask for care assessments and potential council support.

-

Explore NHS Continuing Healthcare (CHC): For complex medical needs, CHC funding can cover costs entirely.

-

Use specialist solicitors: Organisations like the Association of Lifetime Lawyers can review contracts, appeal funding decisions, and ensure transparency.

Transparency and Rights

Care providers must clearly justify fee increases, base them on assessed needs, and communicate them transparently.

The Local Government and Social Care Ombudsman has overturned cases where homes raised fees without proper assessment, showing that families have recourse if increases are unjustified.

Planning Ahead

Navigating care home costs is challenging, but planning, expert advice, and awareness of funding options can make a big difference.

For families like mine, it’s about preserving savings while ensuring loved ones receive the care they need and deserve.