VistaShares is shaking things up with a new exchange-traded fund called BTYB, now trading on the New York Stock Exchange.

At first glance, it looks conservative — most of the money sits safely in US Treasurys.

But look closer and there’s a crypto-flavored edge designed to throw off weekly income while nodding to Bitcoin’s price action.

How the Portfolio Is Split Behind the Scenes

BTYB isn’t diving headfirst into crypto volatility.

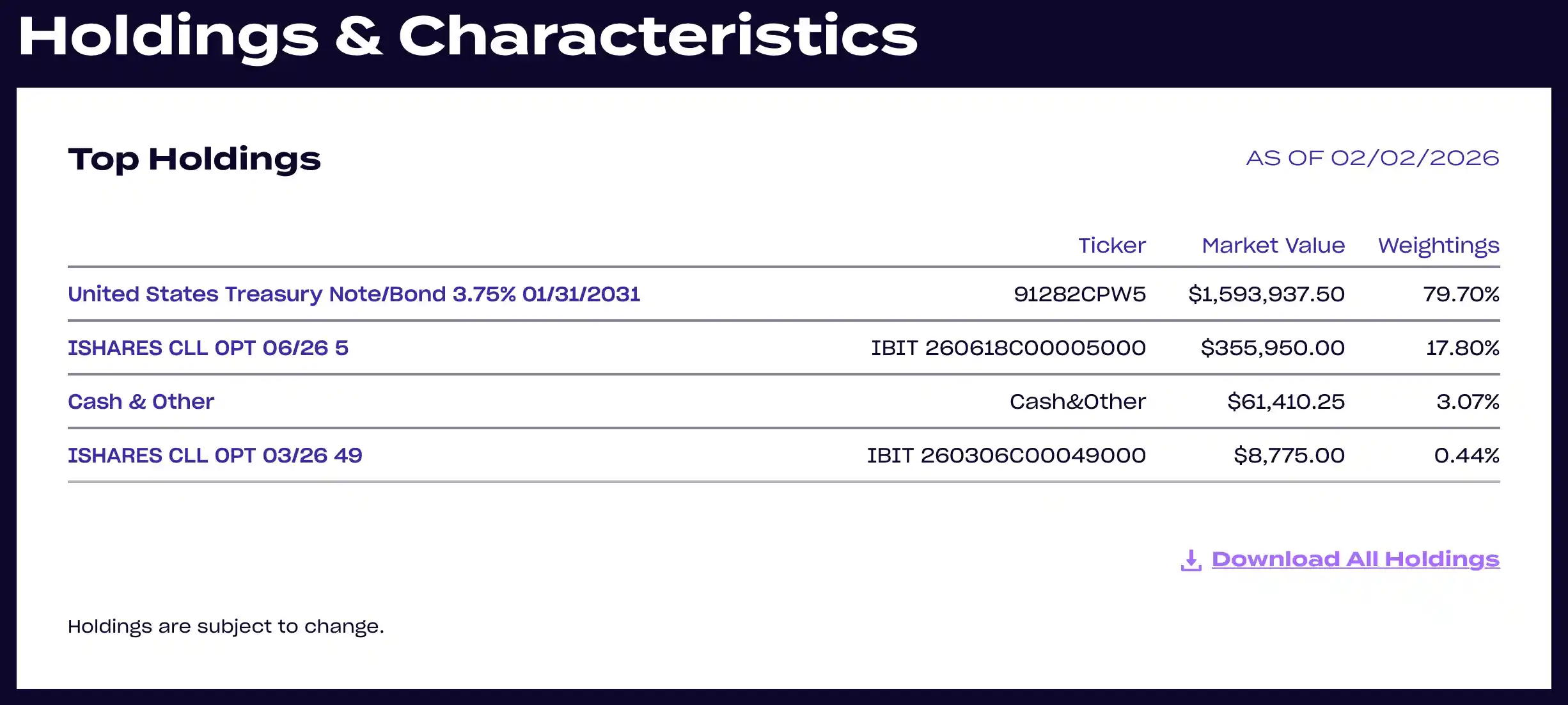

Roughly 80% of the fund is parked in US Treasury securities and similar instruments, anchoring it to government-backed debt.

The remaining 20% is linked to Bitcoin price movements, not by owning Bitcoin outright, but through a carefully constructed options setup.

The Bitcoin Exposure Comes via Options, Not Coins

Instead of holding BTC directly, the fund gets its crypto exposure through call options tied to BlackRock’s iShares Bitcoin Trust (IBIT).

This is done using what’s known as a synthetic covered call strategy — a derivatives-based approach that mimics Bitcoin exposure while selling call options against it.

In plain terms, the fund earns income from options premiums, but in exchange, it gives up some upside if Bitcoin surges.

That trade-off is intentional: steadier income now, capped gains later.

Why BTYB Won’t Track Bitcoin Price Swings Exactly

Because BTYB relies on derivatives rather than spot Bitcoin, it won’t move lockstep with BTC’s market price.

Big rallies may leave some gains on the table, but that’s the price of aiming for higher, more frequent income payouts.

It’s a strategy built for yield-seekers, not pure Bitcoin maximalists.

Chasing Yield With Weekly Distributions

VistaShares says the fund is targeting roughly double the yield of a five-year US Treasury, though it’s quick to note that nothing is guaranteed.

Weekly distributions can rise or fall depending on interest rate shifts and how options markets behave.

The promise here is potential income, not certainty.

Who VistaShares Is and What It Specializes In

VistaShares isn’t trying to mirror traditional index funds.

The firm focuses on actively managed ETFs, often using options strategies and thematic ideas to build products that behave differently from plain-vanilla trackers.

BTYB fits neatly into that playbook.

Crypto ETFs Are Moving Beyond Single Tokens

BTYB’s launch comes as crypto ETF issuers increasingly experiment with mixed-asset and multi-token products.

Investors are clearly looking for more than just “Bitcoin only” exposure.

Late last year, US regulators gave the green light to two spot crypto index ETFs, allowing funds that hold both Bitcoin and Ether to trade on major exchanges.

Those approvals marked a major step toward broader crypto-based investment vehicles.

More Funds Blending Bitcoin With Other Assets

The trend didn’t stop there. In January, Bitwise rolled out an actively managed ETF combining Bitcoin, precious metals, and mining stocks, pitching it as a hedge against the slow erosion of fiat currency purchasing power.

Meanwhile, broader crypto index funds are gaining momentum.

Hashdex expanded its US crypto index ETF to include XRP, Solana, and Stellar, alongside Bitcoin and Ether.

Over at 21Shares, two US-regulated crypto index ETFs now track baskets of large-cap digital assets using FTSE Russell benchmarks.

What This Signals for the ETF Market

Taken together, BTYB and its peers show how quickly the ETF landscape is evolving.

Issuers are blending traditional finance tools like Treasurys and options with crypto exposure, aiming to meet investors halfway — balancing risk, income, and innovation.

What’s Next?

If demand holds, expect even more hybrid ETFs that mix crypto with bonds, commodities, or equities.

For investors, the question won’t just be “Do I want Bitcoin?” — it’ll be “How do I want Bitcoin to behave inside my portfolio?”