All eyes are on Washington this week as President Donald Trump prepares to reveal his choice for the next chair of the US Federal Reserve.

With Jerome Powell’s term set to wrap up in May, Trump confirmed he’ll make his announcement Friday morning, setting off a flurry of speculation across political and financial circles.

Behind the scenes, the name bubbling to the top is Kevin Warsh — a familiar face at the Fed and one that’s already stirring strong reactions in the markets.

Kevin Warsh Steps Into the Spotlight

According to people close to the matter cited by Bloomberg, Trump is expected to nominate Warsh, a former Federal Reserve governor who served from 2006 to 2011.

Reuters also reported that Trump and Warsh met privately on Thursday, and one source described the meeting as a strong showing for Warsh, saying he left a clear impression on the president.

If confirmed, it would mark Warsh’s return to the heart of US monetary policy at a time when inflation, debt, and interest rates remain front-page issues.

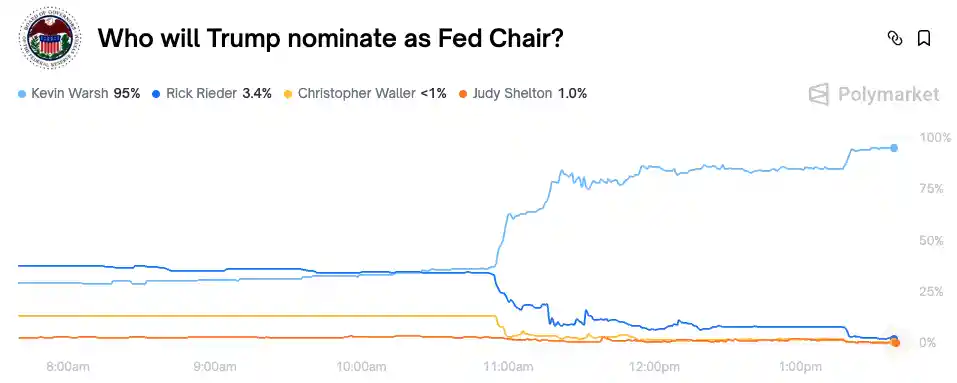

Betting Markets Suddenly Make It Look Like a Done Deal

Prediction markets wasted no time reacting.

On Polymarket, Warsh’s chances of landing the top Fed job jumped dramatically — from roughly 30% to a staggering 95% in a matter of hours.

That surge came at the expense of former frontrunner Rick Rieder, a BlackRock executive, whose odds collapsed to just over 3%.

Kalshi told a similar story. Warsh hovered around 93%, while Rieder trailed at 5%, and economist Kevin Hassett barely registered at 2%.

For many traders, the race suddenly looks all but decided.

Why Warsh Appeals to Trump’s Economic Vision

Warsh has built a reputation as a policy hawk.

He’s often associated with calls for tighter fiscal discipline, a tougher stance on inflation, and a clear exit from quantitative easing.

That philosophy lines up neatly with Trump’s repeated criticism of loose monetary policy and his push for a stronger dollar.

Markets appeared to take that message seriously.

As expectations of a Warsh nomination grew, the US dollar firmed up and Treasury yields climbed, signaling investor belief that a more restrictive Fed approach could be on the way.

A Fed Chair Who Doesn’t Fear Bitcoin

One of the most striking contrasts between Warsh and Powell is their attitude toward Bitcoin.

Powell has frequently downplayed crypto’s relevance to the broader economy.

Warsh, by comparison, sounds far more open — and far less concerned.

In a July interview with the Hoover Institution, Warsh pushed back on the idea that Bitcoin threatens the Federal Reserve’s authority.

Instead, he argued that it can act as a kind of reality check for policymakers.

“Bitcoin doesn’t trouble me,” Warsh said at the time, describing it as an asset that can signal when policymakers are getting things right — or wrong.

He went further, calling it “a very good policeman for policy,” suggesting that decentralized assets can impose market discipline where governments sometimes fail.

Markets React to the Prospect of a More Hawkish Fed

As traders and investors priced in the likelihood of Warsh taking the helm, financial markets responded quickly.

The dollar gained strength, and bond yields rose, reflecting expectations of tighter monetary policy compared to what might have been expected under candidates like Rieder or Hassett.

Whether that reaction holds will depend on Friday’s official announcement — and, later, on how the Senate responds.

What Comes Next for the Fed and Crypto Policy

If Trump does formally nominate Warsh, the conversation will quickly shift to confirmation hearings and the policy signals they send.

For crypto markets, Warsh’s views suggest a Fed chair who may not see Bitcoin as an enemy — even if he remains focused on inflation control and fiscal restraint.

Friday’s announcement could reshape not just the leadership of the Federal Reserve, but also the tone of US monetary policy heading into the next economic cycle.

Share on Facebook «||» Share on Twitter «||» Share on Reddit «||» Share on LinkedIn