Katie Price has once again turned heads with her love life, sharing her first photo with new husband Lee Andrews following a whirlwind wedding in Dubai.

The former glamour model, 47, stunned fans and family alike by tying the knot with Andrews just days after meeting him, leaving many completely shocked.

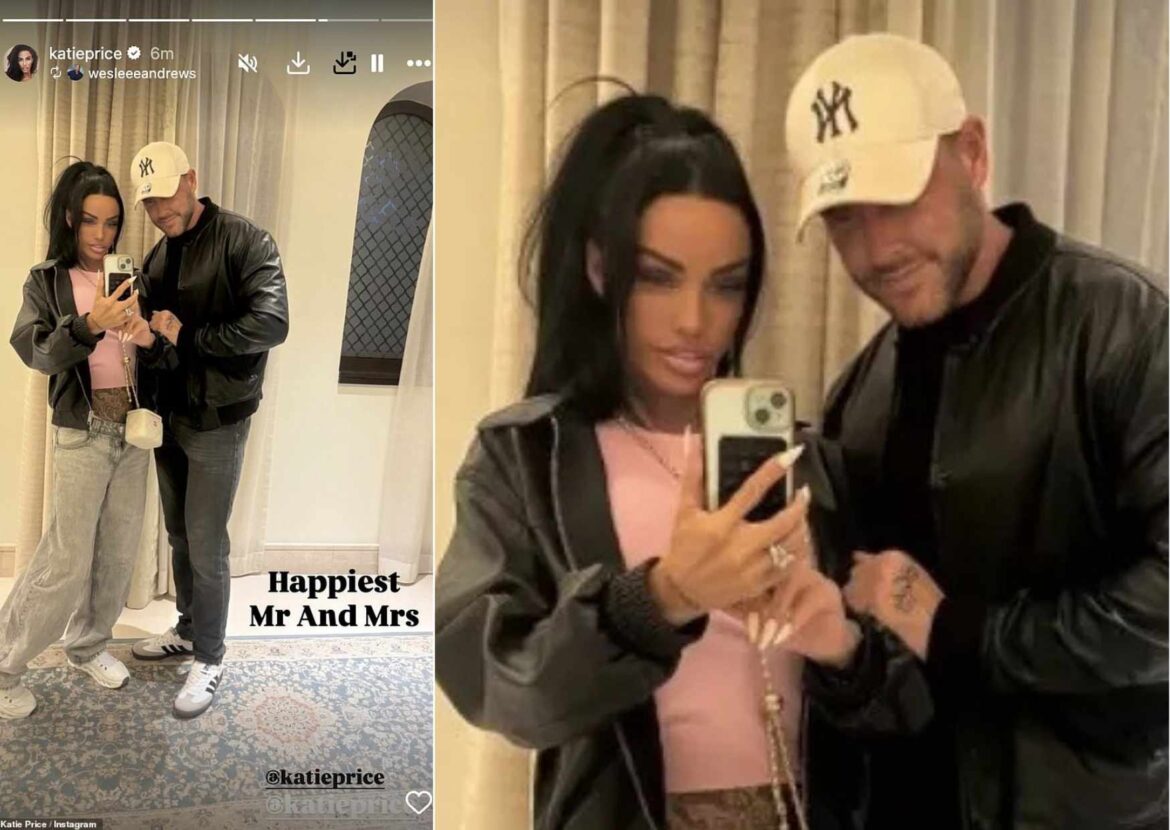

Posting on her Instagram Stories, Katie shared a cozy selfie with Lee, both wearing matching leather jackets, captioned: “Happiest Mr and Mrs.”

The revelation comes just after her split from longtime boyfriend JJ Slater, marking yet another dramatic twist in the star’s romantic life.

Ex-Boyfriend JJ Slater Reacts

JJ Slater, 32, expressed his reaction to Katie’s surprise nuptials in his own laid-back way.

While in Florida, he posted a shirtless mirror selfie on Instagram, flashing a peace sign and a grin, seemingly unfazed by the news.

According to sources, the MAFS UK star was blindsided, spending time with his family as he “heals his broken heart.”

Their breakup, which ended a two-year relationship, reportedly came after Katie realized she didn’t see a future with JJ.

Insiders say cracks in the relationship had been growing for months despite prior discussions about having a child and sharing Christmas together.

A source told the Daily Mail, “Katie had doubts for some time about whether JJ was husband material, but she hoped those concerns would fade. Instead, her fears only grew.”

A Rapid Romance with Lee Andrews

Katie’s romance with Lee Andrews ignited swiftly after connecting online.

Meeting initially through social media, the couple reportedly bought matching rings before ever meeting in person.

“We connected first by words, which captured us both. That evolved deeper as we got matching tattoos and decided to buy rings for each other,” Katie told The Sun.

She described their bond as “destiny” and said Lee “has the best version” of herself.

Lee, originally from Manchester, has lived in Dubai for 21 years and showcases a luxurious lifestyle online.

He describes himself as a multimillionaire CEO of Aura Group Future Urban Travel 2027 and an “Investor in Space X Hybrid Fitness.”

Family Left in Shock

Katie’s family, including her mother Amy and her five children—Harvey, 23, Junior, 20, Princess, 18, Jett, 12, and Bunny, 10—were reportedly blindsided by the wedding.

An insider revealed that the family “had no idea who Lee is” and will have many questions when Katie returns home.

The whirlwind nature of the marriage has raised concerns for the reality star’s well-being, especially following her recent dramatic weight loss.

Katie Addresses Health Concerns

Fans expressed worry after seeing Katie looking notably thin during a recent outing with her daughter Princess.

On her podcast, The Katie Price Show, she explained that she is undergoing tests to understand her sudden weight changes.

“I just want to put on weight, I really do, but I’m just not,” she admitted, stressing that she is eating normally.

Katie also revealed she had booked a doctor’s appointment and blood tests, addressing fans’ concerns while simultaneously sharing her engagement news and calling Lee her “real-life Richard Gere.”

Their celebrations included champagne, strawberries, chocolate cake, and a tattoo of her name on Lee’s hand.

A Look at Lee’s Past

Lee Andrews has been married twice before and reportedly described his ex-wife, personal trainer Dina Taji, as “the perfect woman” less than 18 months ago.

His previous relationships and high-profile lifestyle have drawn attention as he becomes Katie’s ninth fiancé.

Katie Price’s Romantic History

Katie Price has had a famously eventful love life, with three previous husbands:

Peter Andre (2005–2009) – Their marriage blossomed after appearing together on I’m A Celebrity…Get Me Out of Here!

They had three children and shared several TV and music ventures before splitting after four years.

Alex Reid (2010–2012) – Katie married the MMA fighter in Las Vegas shortly after divorcing Peter Andre.

The marriage lasted less than a year, with their divorce finalized in 2012.

Kieran Hayler (2013–2021) – Katie’s marriage to Kieran produced two children, Jett and Bunny.

Despite attempts to renew their vows, repeated infidelity led to their final split in 2018 and divorce in 2021.

What’s Next for Katie?

Katie Price’s love life continues to captivate fans and the media, with this latest marriage sparking both excitement and concern.

Between her health updates, family reactions, and Lee Andrews’ glamorous background, the former glamour model shows no signs of slowing down in her quest for love and happiness.

Share on Facebook «||» Share on Twitter «||» Share on Reddit «||» Share on LinkedIn