BitGo Holdings, best known for safeguarding crypto assets for institutions, has locked in the price for its long-awaited stock market debut.

The company revealed that it will take its initial public offering public at $18 per share, coming in above the earlier marketing range of $15 to $17.

That pricing decision signals strong investor appetite as BitGo prepares to step onto one of the world’s biggest trading stages.

NYSE Debut Is Just Days Away

If all goes according to plan, BitGo’s shares will begin trading on the New York Stock Exchange on Thursday under the ticker BTGO.

The offering itself is expected to officially wrap up on Friday, assuming standard closing conditions are met.

For a crypto-focused firm entering traditional markets, the timing and venue are being closely watched across both Wall Street and the digital asset industry.

How Much Money Is on the Table?

The IPO includes 11.8 million shares of Class A common stock, which at the $18 price tag puts total gross proceeds at roughly $212.8 million.

The bulk of those shares — 11 million — are newly issued by BitGo.

An additional 795,230 shares are being sold by existing shareholders, slightly diluting ownership but not adding fresh cash to the company’s balance sheet.

Who’s Selling — and Who Isn’t

BitGo made it clear that it won’t receive any proceeds from the shares sold by current stockholders.

Those sales strictly benefit the individuals or entities trimming their stakes.

To add flexibility, the company has also granted underwriters a 30-day option to buy up to 1.77 million additional Class A shares at the public offering price, a standard move that could further boost total proceeds if demand stays hot.

Founders and Executives Keep the Biggest Stakes

Recent Form 3 filings with the U.S. Securities and Exchange Commission show that control of BitGo remains firmly in the hands of its founders, senior executives, and early backers.

CEO Michael Belshe stands out among them.

His filing lists one million Class A shares, largely tied to restricted stock units that vest over time.

On top of that, he holds several million Class B shares, which can be converted into Class A stock, along with option grants that could translate into millions more shares if exercised.

A Look Inside the Ownership Filings

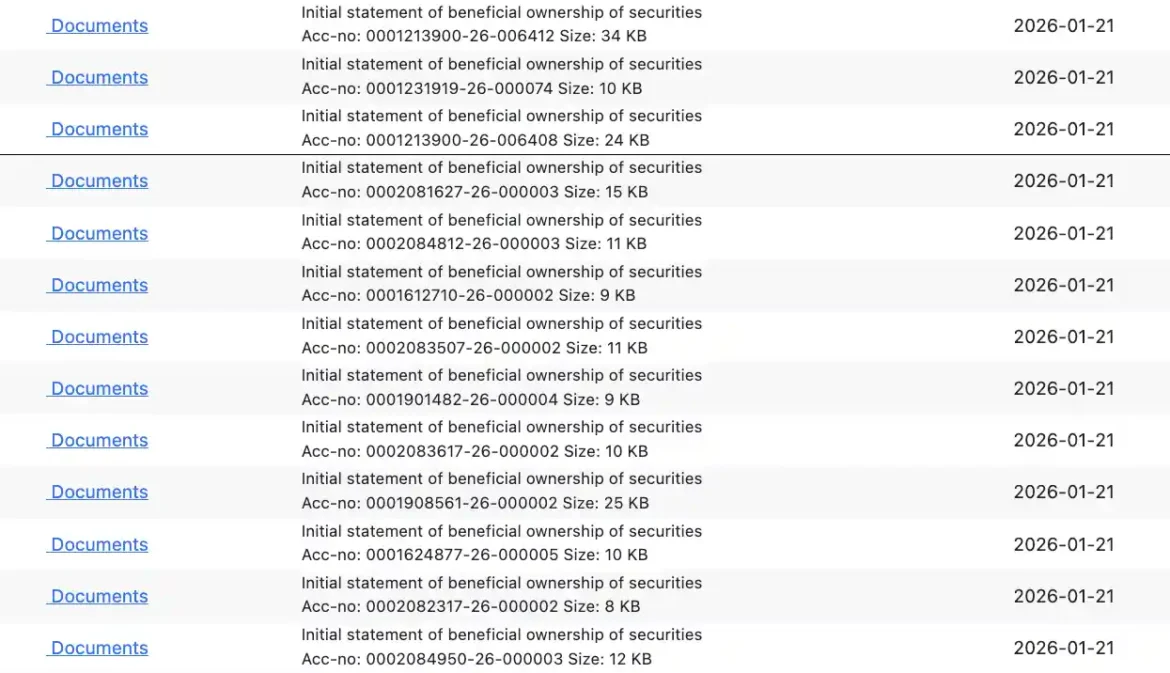

In total, 13 BitGo stakeholders filed Form 3 statements on Wednesday, outlining beneficial ownership ahead of the IPO.

The disclosures highlight holdings by key leaders such as chief revenue officer Fang Chen and board chairman Brian Brooks.

Not every name on the board came with shares attached, though.

Newly appointed director Vivek Krishna Pattipati, for example, reported owning no BitGo stock at the time of filing.

Institutional Investors in the Mix

Beyond executives, the filings also reveal ownership by investment firms, including Valor Equity Partners and Redstone, reinforcing the idea that BitGo has long attracted institutional interest — a theme that aligns neatly with its business model.

A Crypto IPO With Eyes on the Future

BitGo’s IPO arrives as the broader crypto sector continues to mature, with more companies weighing public listings amid shifting regulations and renewed investor confidence.

As other firms, such as Anchorage Digital, reportedly explore similar paths, BitGo’s debut could serve as a bellwether for what’s next.

For now, all eyes are on Thursday’s opening bell — and whether BTGO’s first trades justify the optimism baked into that $18 price.

Share on Facebook «||» Share on Twitter «||» Share on Reddit «||» Share on LinkedIn